| Welcome To LTC Insurance Compared |

|

| "Long term care is the largest unsecured risk facing Americans today." – Money Magazine. |

Why Insure?

| In these days of economic uncertainty it is essential that people have a sense of security in terms of their future. Long term care insurance is a way to preserve that. Like car insurance, the prices for long term care insurance will vary by company. The premium will depend on your age, health and the benefits you want. The LTC Partnership Program provides asset protection in most states. Some people prefer a life insurance or annuity with long term care benefits. Each option has advantages and disadvantages, we help you decide.

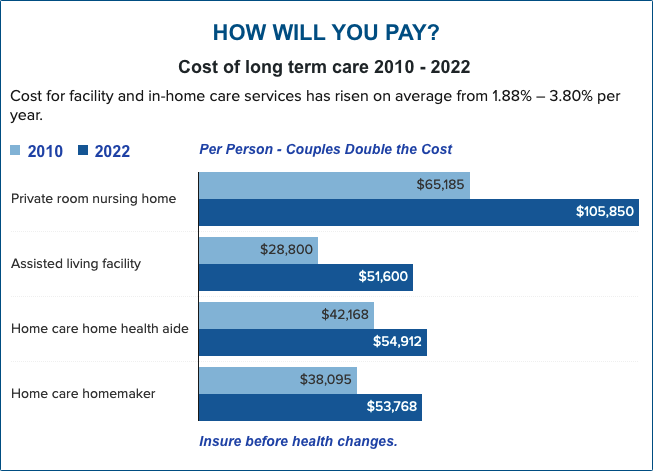

Since care costs will differ by type of care and location it is important to get the right information to make an informed decision. Watch videos. |

|